Monitorul SFS

INVITATION FOR EXPRESSIONS OF INTEREST (CVs) Position: International Information Technology Consultant

Expressions of interest must be delivered electronically by e-mailanastasia.movila@sfs.md andmihaela.doros@sfs.mdbyJune 08, 2018, 17:00.

Interested consultants may obtain further information at the address below during office hours from 09:00 to17:00 (Chisinau time).

State Tax Service

9 Constantin Tănase street.,

Chisinau, Republic of Moldova

anastasia.movila@sfs.md,

mihaela.doros@sfs.md

Tel: + 373 22 82 33 75

+373 22 82 34 34

Expressions of interest must be delivered electronically by e-mailanastasia.movila@sfs.md andmihaela.doros@sfs.mdbyJune 08, 2018, 17:00.

Interested consultants may obtain further information at the address below during office hours from 09:00 to17:00 (Chisinau time).

State Tax Service

9 Constantin Tănase street.,

Chisinau, Republic of Moldova

anastasia.movila@sfs.md,

mihaela.doros@sfs.md

Tel: + 373 22 82 33 75

+373 22 82 34 34

Attachment: Terms ofReference.

Attachment

Terms of Reference for International Consultant to Review Moldova ITMS Feasibility Study

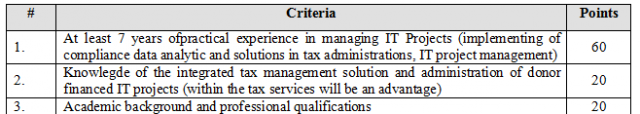

Background 1.1. General Background. The World Bank (WB) is supporting modernization of the Moldova Revenue Administration, State Tax Service (STS), through the Tax Administration Modernization Project (TAMP). As part of the due diligence required to document and support an implementation strategy decision for Component 4 of the project, implementation of an Integrated Tax Management Solution (ITMS), the World Bank has requested that the STS complete a feasibility study of the new option presented by the STS to extend and reengineer the existing tax solutions and infrastructure to achieve an ITMS. This document was developed by STS in collaboration with their IT service provider, Fiscservinform (FSI), a state-owned enterprise. The implementation options are defined in the document “Framework and TOR for ITMS Implementation Feasibility Study” (Framework) which guided the completion of the Feasibility Study developed by the STS (Feasibility Study) and is the general reference guide to be used in this review regarding its completeness and the Consultant recommendations regarding the probability of a successful ITMS outcome. The findings from the Review of the Feasibility Study (Review) will guide the finalization of the STS IT implementation strategy decision and further procurement, resourcing, and IT implementation going forward. 1.2. Objectives of the Assignment The objective of the assignment is to review the Feasibility Study and assess whether it is sufficiently detailed and complete to enable project launch and, that it is a viable and achievable implementation option that would meet the TAMP ITMS objectives within the proposed budget and time available. The assignment shall include, consulting services to complete review and assessment of the Feasibility Study based on the Framework as provided by the World Bank. Scope of Work The assignment requires an expert with complementary skills. It is estimated to entail 3-person weeks of input (90% of time in the field) over the period of the consultancy, covering assistance, coordination, reporting and presentation of the analysis, findings, and recommendations to the STS. The reporting should be two-phased (providing a rough draft of findings the end of the second week) to allow adequate time for interactive consultations and reviews of the deliverables by the STS. The Consultant will perform the assignment activities as set out below. 2.1. Activities To achieve the assignment objectives, the Senior Analyst Consultant is expected to perform the following tasks: a) Complete research, analysis, and Review drafting based on the Framework provided by the World Bank, key source documents (the Feasibility Study and related appendices or annexes), and interviews with stakeholders from the STS, FSI, the Ministry of Finance, and other appropriate stakeholders such as e-Gov. b) Findings of the Review are to include the international consultant assessment of, and any recommendations for, the completeness, feasibility, and capacity to execute this strategy. This will be done by answering the following key questions: i. Will it result in a sustainable infrastructure going forward? ii. Will the application architecture and design proposed meet the requirements of an integrated tax management solution? iii. Will the ITMS applications be sustainable? iv. Will there be an integrated source of data foundation to support compliance and enforcement analytics? v. Is the implementation strategy and plan realistic and achievable in terms of: Project implementation strategy and plan including schedule, resource, and cost estimates, Procurement strategy and plan, and Resourcing strategy and plan? vi. Have key project risks been identified along with mitigation strategies and, are the mitigation strategies sufficient? c) Present the draft Report which will include findings and recommendations to the STS management and discuss questions or concerns raised during the early draft review. d) Finalize the Report considering the STS’s comments (when agree) and share with the STS. The Consultant will work with the STS and FSI stakeholders under the direction of the STS TAMP Project Manager – Deputy Director of the STS, with day-bay-day support provided by a coordinator designated by the STS. 2.2. Deliverables The key deliverable from the Consultant will be the assessment Report as described in 2.1 b), c) and d) above. The report is to be presented to STS senior management for review and questions in early draft and then final form during the mission. The report content must include the professional opinion of the consultant per 2.1 b) above including answers supported by objective and subjective analysis to each question raised. 2.3. Timing and Inputs (i) The scope of report and the mission’s arrangement shared with the STS in 5 days from the contract starting date; (ii) The mission starts not later than in 2 weeks after the contract start day, and be completed not later than in 5 days by the contract’s closing date. (iii) The draft Report is shared with the STS not later than in 15 calendar days after the mission’s start. (iv) The final Report is shared with the STS by the end of the mission. 2.4. Languages The Consultant shall work in the English language. Documents shall be submitted in English. 2.5. Reporting relationship and payment The Consultant will report directly to Deputy Director, who oversees the activity related to the project implementation, and will coordinate day-to-day with a resource designated by the STS. STS will provide a primary resource and support to arrange meeting space, meeting scheduling and coordination, and logistics. In the Consultant’s working relations with the STS, FSI, and all the key stakeholders, the Consultant will be expected to be self-sufficient and conduct himself/herself in the highest professional manner. The Client will pay the Consultant for Services after the receipt of the final report, acceptable to the Client. The payment will be made in the currency of financial proposal submitted by the Consultant under international consultancy contract (preferably in USD). The payment will be made not later than 30 days following submission of approved report and invoice. 2.6. Resources provided The Consultant shall be available to travel to the Republic of Moldova during the assignment and shall be responsible for all logistics during the contract implementation. The Consultant will be provided the English versions of the Framework and Feasibility Study itself including annexes and appendices, when the contract becomes effective. Consultant Selection Profile 3.1. Qualifications and certifications Consultant will be required to have the following professional qualifications: - Not less than 7 years of practical experience in managing IT projects. University degree in business administration, IT engineering, or related fields; - Substantial leadership, IT project management and change management expertise. Proven ability to communicate project issues with high ranking government officials, and to resolve key issues quickly, will be essential; - Experience in implementing compliance data analytic, mining, and reporting tools and solutions in tax administrations; - Abilities to communicate, negotiate, analyze, elaborate and present reports; - Ability to build trust and work effectively with STS and FSI management and staff; - Ability to manage an assignment and stay on schedule and within the budget; - Fluency in English; fluency in Romanian or Russian languages will be an advantage; - Excellent computer skills; - Strong oral and written communication skills; - International recognized Project management certifications. Advantage will be: - Familiarity with World Bank procedures; - Experience in administration of donor financed IT or /and Tax administration modernization projects; - Experience in the development and implementation of integrated tax management solution IT systems in state tax authorities; - Work experiences in tax administration including compliance programs.„Acest articol aparține exclusiv P.P. „Monitorul fiscal FISC.md” și este protejat de Legea privind drepturile de autor.

Orice preluare a conținutului se face doar cu indicarea SURSEI și cu LINK ACTIV către pagina articolului”.

Autentificare

Autentificarea se poate efectua cu ajutorul adresei de E-mail sau a Login-ului

E-mail/Login *

Parola *

Contul de utilizator a fost creat cu succes. Pentru confirmarea înregistrării accesați linkul expediat la e-mailul indicat în formularul de înregistrare, care este valabil până la 30 zile calendaristice

Adresează-ne o întrebare

Dorești să obții un răspuns rapid si complex sau să ne sugerezi tematica unui articol necesar procesului tău de lucru? Loghează-te, expediază întrebarea sau sugestia și primești răspunsul experților în cel mai scurt timp la adresa de e-mail sau în profilul tău de pe pagină.

E-mail *

Comanda serviciului prin telefon

Introduceți corect datele solicitate și în scurt timp veți fi contactat de un operator

Prenumele *

Numele *

E-mail *

Telefon *

Feedback

Pentru monitorizarea statutului de prelucrare a Feedbackului expediat, recomandăm inițial să parcurgeți procesul de autentificare pe portal. Astfel, mesajul de răspuns din partea PP „Monitorul Fiscal FISC.md” la feedback se va salva și afișa în Profilul Dvs. În cazul expedierii feedback-ului fără a fi autentificat pe portal, mesajul va fi remis la adresa de e-mail.

E-mail *

E-mail *

3576 vizualizări

Data publicării:

25 Mai /2018 10:45

Catalogul tematic

Administrare fiscală | Noutăți

Etichete:

SFS | TAMP

0 comentarii

Doar utilizatorii înregistraţi şi autorizați au dreptul de a posta comentarii.